Calm Waters

The S&P 500 rose modestly to post its fourth straight week of gains. Despite some obvious headwinds, investor “fear”, as measured by the Volatility Index, is near historic lows thanks in part to a good start to the corporate earnings season.

Market Update

Contributed by Doug Walters

Calming Nerves

In a week that had every right to be volatile, U.S. equity markets were remarkably sanguine, with the S&P 500 ending the week up a respectable 0.6%. In theory, equities dislike uncertainty, yet uncertainty is in abundant supply. The world economy is still digesting Brexit, terrorism is front of mind following last week’s attack in France and Friday’s incident in Germany, U.S. equities are near an all-time, the U.S. presidential conventions are stirring political emotions, and corporate earnings season has kicked off in earnest.

- Thus far, second quarter corporate results have been fairly robust, and are a calming influence on investor’s frayed nerves. About 25% of the S&P 500 has reported with 70% surprising to the upside on earnings.

- At the sector level, Health Care and Industrial stocks have been particularly successful at beating expectations.

Fear Factor

The relative market calm experienced this week is evident in the Volatility Index (VIX). The best way to think about this index is as a measure of investor fear. The more fearful (or uncertain) investors are about the coming months, the higher the index value. Following a Brexit spike, the index has steadily been declining and now sits near historic low levels.

- While a low ‘fear factor’ is generally a good signal, contrarians will point out that the bar for equities is set very high currently with little room for any economic, earnings or geopolitical missteps.

- A continued successful earnings season is the 1st important step to providing equity valuations with some margin of safety.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.6 | 6.4 |

| S&P 400 (Mid Cap) | 0.6 | 11.0 |

| Russell 2000 (Small Cap) | 0.6 | 6.8 |

| MSCI EAFE (Developed International) | 0.4 | -3.4 |

| MSCI Emerging Markets | 0.4 | 9.7 |

| S&P GSCI (Commodities) | -2.8 | 12.6 |

| Gold | -0.4 | 24.5 |

| MSCI U.S. REIT Index | 1.8 | 15.1 |

| Barclays Int Govt Credit | 0.1 | 3.0 |

| Barclays US TIPS | -0.1 | 5.8 |

Economic Commentary

Where is the Price of Oil Headed?

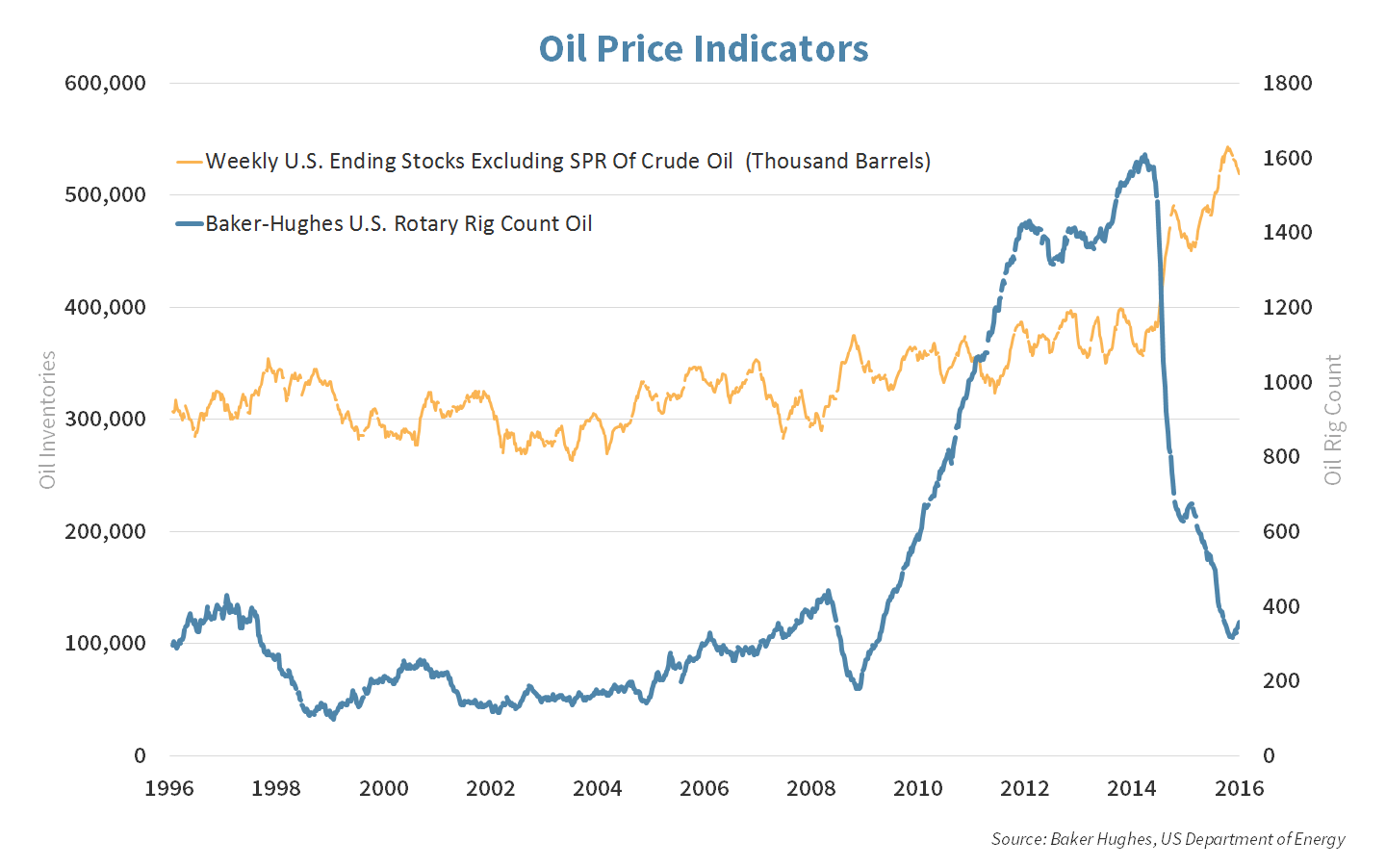

As consumers continue to benefit from lower oil prices and use that “tax cut” to stimulate the economy with decent spending, we examine key indicators that will determine the price of oil. These indicators include oil inventory levels and the oil rig count (shown below.) An increased rig count would add to future supply and therefore add to inventory levels which would in turn keep oil prices low.

Inventory levels are relatively high but down 24 million barrels from their April record. The oil rig count dropped dramatically with the price of oil last year but is up from its May low. Oil field service companies, such as Schlumberger and Halliburton, are optimistic that the rig count will in fact increase.

Halliburton CEO David Lesar this week predicted a “modest uptick” in the rig count for the second half of the year while Schlumberger CEO Paal Kibsgaard stated “we now appear to have reached the bottom of the cycle.” If they are correct and more rigs are added, oil supply will increase and prices will more likely remain lower for longer.

Week Ahead

Clinton’s Day

The RNC has officially wrapped up in Cleveland, and it is now the Democratic Party’s turn in the city of Brotherly Love (Monday-Thursday).

- Hillary Clinton will be accepting the nomination on Thursday. She will be the final speaker to take the Convention stage.

- Investors will be listening carefully to her speech for additional guidance on her policy priorities.

Fed vs. Brexit

The Federal Reserve policy makers will be concluding their two-day post-Brexit meeting this Wednesday.

- The Fed is expected to keep interest rates flat this month, but investors will be looking towards Yellen & Co. for guidance on the future path of interest rates. Expectations for future interest rate hikes spiked lower at the end of June and have since been ticking back higher.

Poke-play

Both Strategic Holdings of Alphabet (GOOG) and Apple (AAPL) will be reporting quarterly earnings on the week ahead.

- Both companies will be experiencing gains from the recently popular mobile app Pokémon Go, though it is unlikely to have moved the needle in Q2.

- It will be a busy week for earnings, with other Strategic bellwethers such as Caterpillar (CAT), Boeing (BA) and Exxon (XOM) reporting.

Strategy Update

Contributed by Max Berkovich ,

Strategic Asset Allocation

Net Zero

The British Pound was trading around $1.31 earlier this week, up from the multi decade lows of $1.28. The lift to the Pound and Euro came as the Central Bank decided to leave interest rates unchanged. However, by the end of the week the US dollar edged higher against both positive economic data and a rise in probability of a Fed rate hike by year end.

Oil Glut

Oil led a broad decline in the commodity markets, with Natural Gas the notable exception bucking the downward trend. Gold traded lower on Friday, but is still holding on to most of the gains of the past six months.

Mount Everest

U.S. Equity markets climbed cautiously higher, with investors reacting positively to corporate earnings and guidance. Sentiment continues to trend upward as investors are gaining confidence in the US economy. That move higher in investor confidence is viewed by some as a contrarian indicator for future returns.

STRATEGIC Growth

Transistors and resistors

The energy sector stood out as a big laggard this week, while the technology sector had a major chip-in from the semiconductors. In addition to a major M&A deal, a few reasons for the move…

- Qualcomm Inc. (QCOM) blew away expectations with its 3Q results. Much awaited progress in China is finally showing up in numbers. The company also bumped up annual guidance.

- NXP Semiconductors N.V. (NXPI) had a block of over 10 Million shares being shopped mid-week. While a secondary that size may scare investors, this one was celebrated as it was an exit by Private Equity funds who had major stake in the company since it was sold by Phillips N.V. (PHG) in 2006.

- Skyworks Solutions, Inc. (SWKS) on the other hand spooked investors when their solid earnings release indicated above average inventory. The company did beat estimates, increased its dividend and initiated a $400 Million stock buyback.

STRATEGIC EQUITY INCOME

Chasing Clouds

Utilities gained back some of their low interest rate mojo this week to claim the top spot in the strategy, while the Industrial sector landed on the bottom. In other strategy news…

- Microsoft Corp. (MSFT) topped expectations when it announced its quarterly results. The cloud division Azure reported a 102% revenue jump year over year.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters