A Call to Action

An encouraging jobs report temporarily breathed life into U.S. equities that are feeling the weight of a contentious presidential election. An investor’s best course of action is to stay squarely focused on the long-term, and get out and vote!

Market Review

Contributed by Doug Walters

Pay Up

A Friday bounce following the latest jobs report proved to be fleeting, and U.S. Equities ended the week down nearly 2%. With the November Fed meeting press release a non-event, markets had little to distract them from the ever-looming presidential election.

- The initial bump in equities on Friday was courtesy of an encouraging October jobs report. While the 161K jobs created was nothing to write home about, the continued increase in wage growth is just what the doctor ordered.

- Annual wage growth has been trending close to 2% for much of the past six years, hampering the economic recovery. However, the last 12 months has seen an acceleration, and now 3% growth is within reach.

Presidential Play

Many have attributed the recent sell-off in U.S. equities to the changing dynamics in the presidential polls, with the gap between the candidates closing. As Trump gains ground, the market sells off. Should we conclude then that Trump is bad for the economy?

- Not necessarily. We have said numerous times that equity markets dislike uncertainty. The recent moves are much more likely to be a referendum on Trump’s trademark unpredictability than a long-term view on his economic plan. Clinton is more of a known quantity, and her policies are likely baked into equity prices. As Trump gains favor, uncertainty rises, and it makes sense for equities to reflect this in lower valuations.

- Is there a way to play this dynamic in the short-term? It is not worth it. The above argument gives a hint as to how the market would react in the short term to the election results, but that says nothing about the long-term, which is what we believe investors should focus on, regardless of who wins the election.

- In our opinion, the best way to “play” the election is to get out and exercise your right to vote!

Economic Commentary

It’s the Economy Stupid

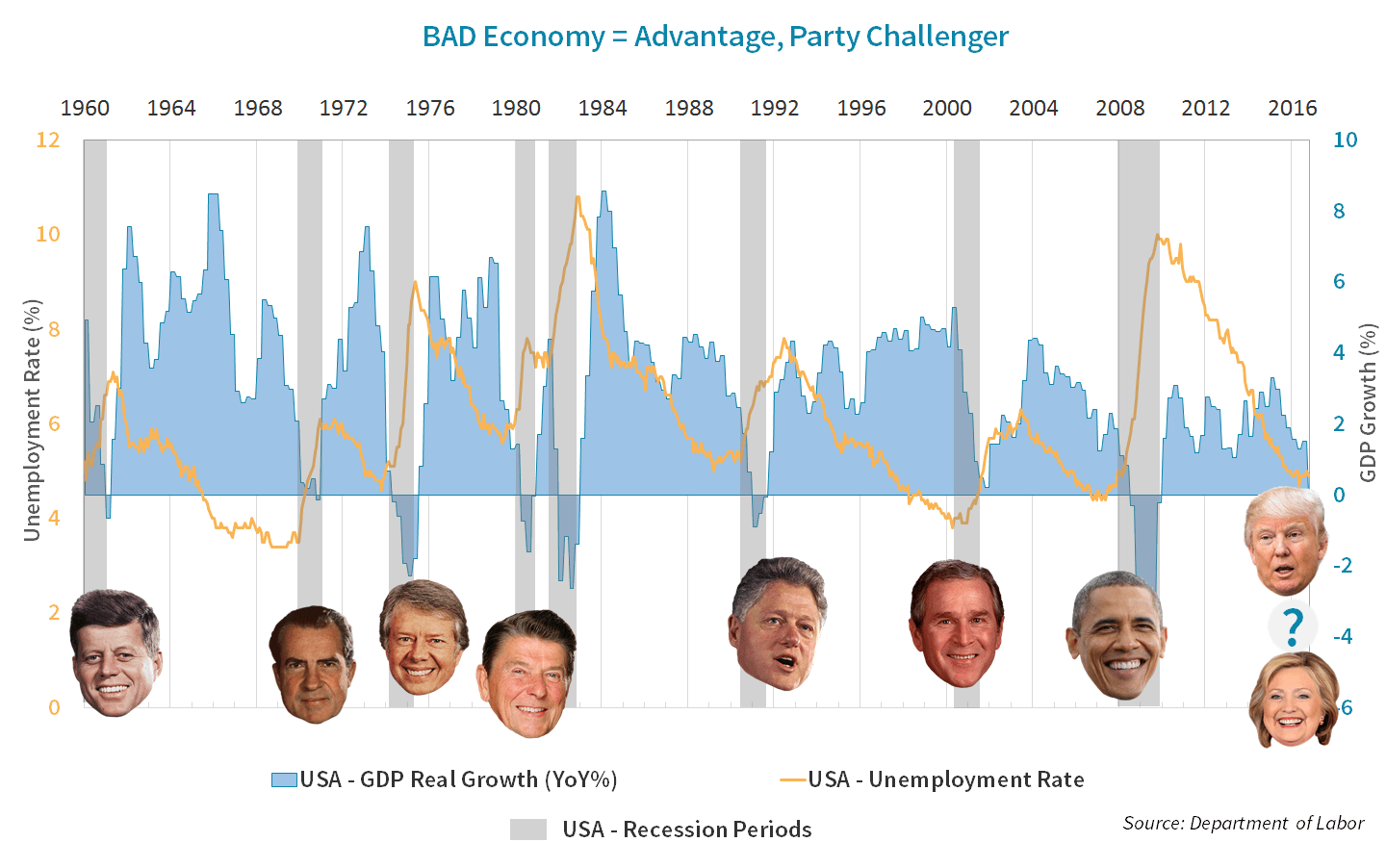

History suggests that it is the economy more than any other issue that determines whether the incumbent party wins the presidential election. Barack Obama rose to power right after the financial crisis as economic anxiety led voters to choose the change candidate. Bill Clinton won his first presidential election with a simple message, “It’s the economy, stupid”, following the 1991 recession. For all the dramatic issues this election cycle, it may end up being the level of economic strength that decides who becomes president.

The chart below shows that when there is a combination of high unemployment and low GDP growth, presidential incumbents have a difficult time maintaining the presidency.

So how is the U.S. economy faring? The Department of Labor stated that GDP grew at annual rate of 2.9% this past quarter which is considered high when compared to recent quarters, but still slightly below the average since 1960. It is very low when compared to the growth rates of developing nations such as China, but that should be expected.

Unemployment, at 4.9% is exceptional. Yet there are those who claim this is artificial, and that many workers have dropped entirely out of the workforce. Some politicians have blamed this on trade deals. Most economists agree that free trade deals such as NAFTA and the TPP help the overall economy grow. With more trade, American exporters have larger markets to target and consumers can import at lower costs helping to slow inflation. The downside to free trade comes to workers that lose their jobs because they can not compete with low emerging market wages.

Although the overall economy has steadily recovered since the financial crisis not everybody has participated, making this election a close one.

Week Ahead

Decision Time

The biggest event of the year is finally here. The U.S. Presidential Election will take place on November 8th. The race for the White House is heating up as polls are now indicating a closer race between the two candidates.

- The main event may be the Presidential seat, but we would remind our readers the Senate and House results may sway the leadership in Congress. Equity markets tend to like a different party controlling the legislative body than the one in charge of the executive branch.

- Fun Fact: In the 1984 presidential election, Ronald Reagan received both the highest number of popular votes and the highest number of electoral votes in the history of U.S. presidential elections. These numbers have yet to be surpassed by another presidential candidate.

On the Clock

Don’t forget to set your clocks back an hour this Sunday on November 6th.

- According to History Channel, the thought that turning our clocks back in the fall and ahead in the spring saves energy is false.

- We hope last week’s Halloween trick didn’t catch too many readers off-guard.

Strategy Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

Slim Pickings

U.S. Equities finished in the red for the week with REITs and small cap leading the pack lower. Commentators have blamed the election polls for the decline, as the race for the presidency has tightened. Gold was the safe haven of choice, ending the week in positive territory.

Polling Data

US interest rates are slowly making their way up as economic data continue to show improvement. Per Bloomberg’s US Fed rate hike probability measure, the chances of a December Fed rate hike have risen to 76% from 50% in September. Short-term yields have also climbed, pricing-in the likely move by the Federal Reserve.

- Bonds with longest maturities should in theory lose the most value when interest rates increase.

- Our current fixed income strategy is well positioned against rising rates as our portfolios target relatively short maturities versus the market.

Fair and Balanced

While there have been some recent declines in equity markets, these moves have not yet warranted a wholesale rebalance.

Strategic Growth

Separation of Church & State

The consumer sectors had a rough week. The Health Care sector also felt some pain as the U.S. Department of Justice is investigating price collusion charges in the drug space. In other strategy news…

- Church & Dwight Co. Inc. (CHD) manufacturer of the Arm & Hammer and OxiClean brands reported an inline quarter, but a very slow organic growth rate for the quarter and lowered guidance to the low points of its previous projections.

- Johnson Controls Plc (JCI) finally spun-off its automotive parts manufacturing into a separate company called Adient Plc (ADNT). Shareholders of Johnson Controls received one share of the new company for every ten shares of JCI. The new company is under review.

Strategic Equity Income

Drill, Baby, Drill

Consumer Discretionary was the top finisher on the week, while the Energy and Technology sectors jostled for last place. Speaking of Energy…

- Occidental Petroleum Corp. (OXY) the oil and gas exploration company reported a disappointing quarter. The company reported a larger than expected loss on the heels of a production decline of 12%. The company surprisingly announced an increase in spending for next year as peers continue to cut spending. OXY is expected to drill 115 wells next year, which would increase production by double digits.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters